Shale oil pioneers say the boom times are over

The days of relentless production growth from U.S. shale oil fields are ending, potentially aiding OPEC’s years-long effort to drain a worldwide supply glut, according to industry pioneers Scott Sheffield and Mark Papa.

Investor calls for shale producers to shut down rigs and stop burning through cash are being heeded, Pioneer Natural Resources Co. Chief Executive Officer Scott Sheffield said on Tuesday. Across the American shale industry, output growth will slow next year, providing a boost for crude prices through the early 2020s, he said.

“I don’t think OPEC has to worry that much more about U.S. shale growth long term,” Sheffield said during a conference call with analysts. He’s “definitely becoming more optimistic that we’re probably at the bottom end of the cycle regarding oil prices.”

Talk of a shale slowdown reached a fever pitch this year as investors crushed drillers’ stocks and demanded spending discipline. As if on cue, Occidental Petroleum Corp., Apache Corp., Cimarex Energy Co. and Pioneer all are signaling plans to trim budgets.

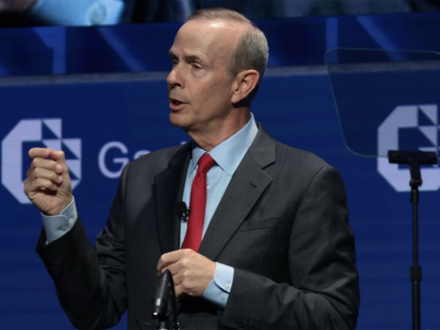

Mark Papa, who built Enron Corp. castoff EOG Resources Inc. into one of the world’s biggest independent oil explorers and now runs Centennial Resource Development Inc., has been sounding the alarm on shale growth since at least February. In reiterating that warning on Tuesday, he said the slowdown will be more dramatic than he predicted as recently as nine weeks ago.

Beyond 2020. Papa downgraded his 2020 shale growth forecast to 400,000 bpd compared from the 700,000 bpd estimate he discussed in early September.

“This is likely not just a 2020 event,” Papa said during Centennial’s third-quarter results call. “I believe U.S. shale production on a year-over-year growth basis will be considerably less powerful in 2021 and later years than most people currently expect.”

Sheffield sees about 700,000 bpd being added next year while the Energy Information Administration predicts that next year’s daily production will expand by 910,000 bbl. Even the EIA’s figure is half of 2018’s increase.

Crowded Wells. For Papa, there’s a more fundamental reason driving the downturn in shale than investor sentiment. Many producers have drilled their best locations and are now turning to lower-quality sites. Some also have been drilling wells too close together, resulting in a loss of overall performance.

The counterpoint to Sheffield and Papa’s gloomy outlook is the supermajors Exxon Mobil and Chevron, which are ramping up Permian basin drilling. Each plan to produce about one million barrels a day from the basin by the early 2020s. That may provide a silver lining for independent producers: an opportunity to get bought, Sheffield said.

The majors will have “to decide whether or not to bulk up their inventory over the next two to three years and decide whether or not to acquire any independents,” he said.

Fuente: https://www.worldoil.com/news/2019/11/6/shale-oil-pioneers-say-the-boom-times-are-over

Etiquetas

Publicado por OIL CHANNEL

Noticias relacionadas

Las áreas concedidas al consorcio son dos amplias zonas marítimas de una superficie total de 47.000 kilómetros cuadrados al sur de la isla griega de Creta y de la... Leer más

La defensa del Estado presentó una solicitud de corrección del Laudo de Cuantificación de Daños, que fue emitido 17 de noviembre Ecuador deberá pagar... Leer más

Martin Ravelo, presidente de la Unión Sindical Obrera (USO), afirmó que defenderá el Permian y la producción de petróleo y el gas en Colombia. Un nuevo... Leer más

La firma ingresó en el total de 2025 unos 189.031 millones de dólares, que supone un aumento del 6,8% comparado con los 202.792 millones de 2024 La petrolera... Leer más

Los directivos de Exxon Mobil y Chevron podrían enfrentarse a más preguntas sobre sus oportunidades de inversión en Venezuela que sobre sus resultados trimestrales reales... Leer más

El país ha firmado acuerdos estratégicos con la estadounidense Chevron y ConocoPhillips y la francesa TotalEnergies, además de un memorando de entendimiento con el Gobierno... Leer más

Según la firma "este proceso se desarrolla "bajo esquemas similares a los vigentes con empresas internacionales, como Chevron". La petrolera estatal de Venezuela, Petróleos... Leer más

La cuenca de Mauritania, Senegal, Gambia, Guinea-Bissau y Guinea-Conakry ha atraído especial atención a medida que su potencial geológico se hace más evidente. El... Leer más

El gigante petrolero francés justificó esta venta a Chevron para reforzar la "cooperación mundial" entre las dos compañías. El grupo petrolero... Leer más